30+ does a mortgage count as debt

Reasons Why Mortgage is Counted as a Debt There are. When the borrower owns mortgaged real estate the status of the property determines how the existing propertys PITIA must be.

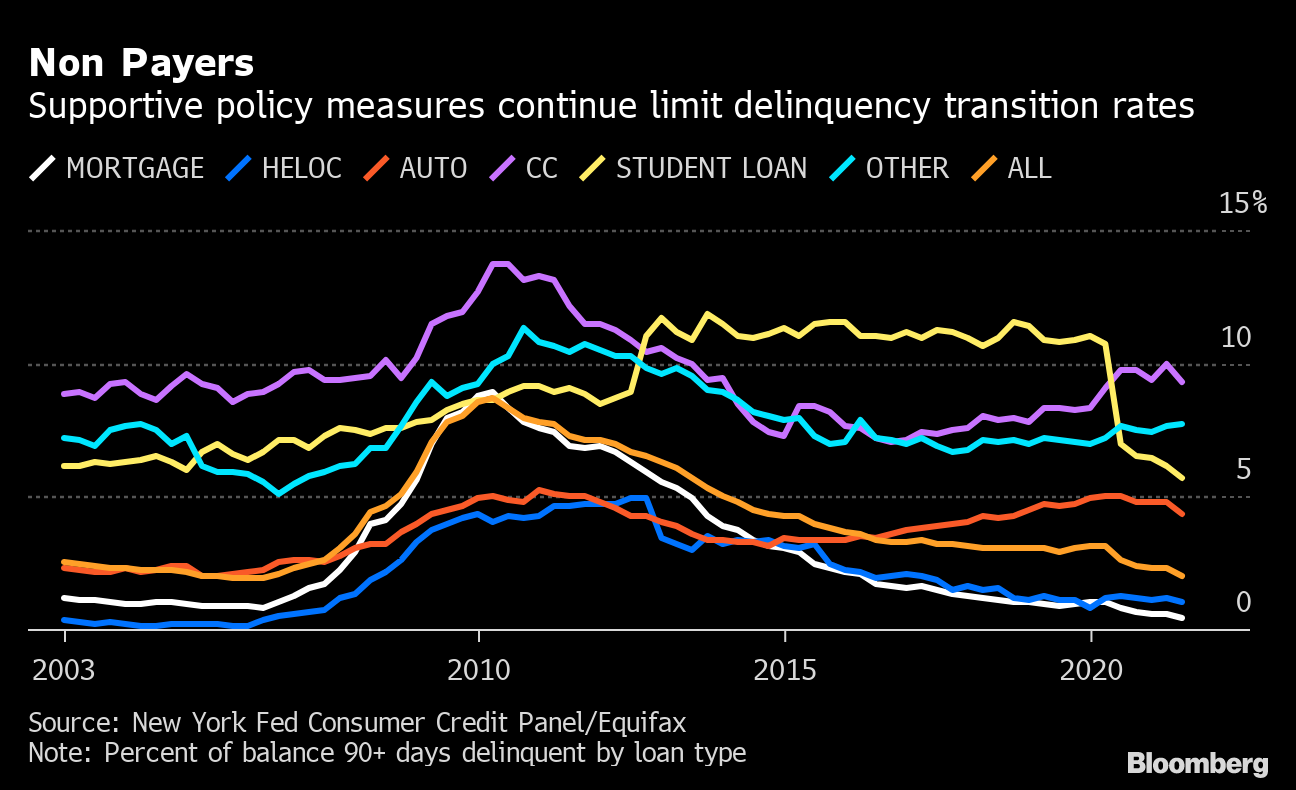

Us Mortgage American Household Debt Jumps Most Since 2013 On Boom Bloomberg

Web 36 to 41.

. Lots of homeowners do not consider their mortgages when they calculate their total debts. Web Most of the amounts are manageable. Web You might not think of your mortgage as a debt but you should realize that your mortgage should still be counted as one.

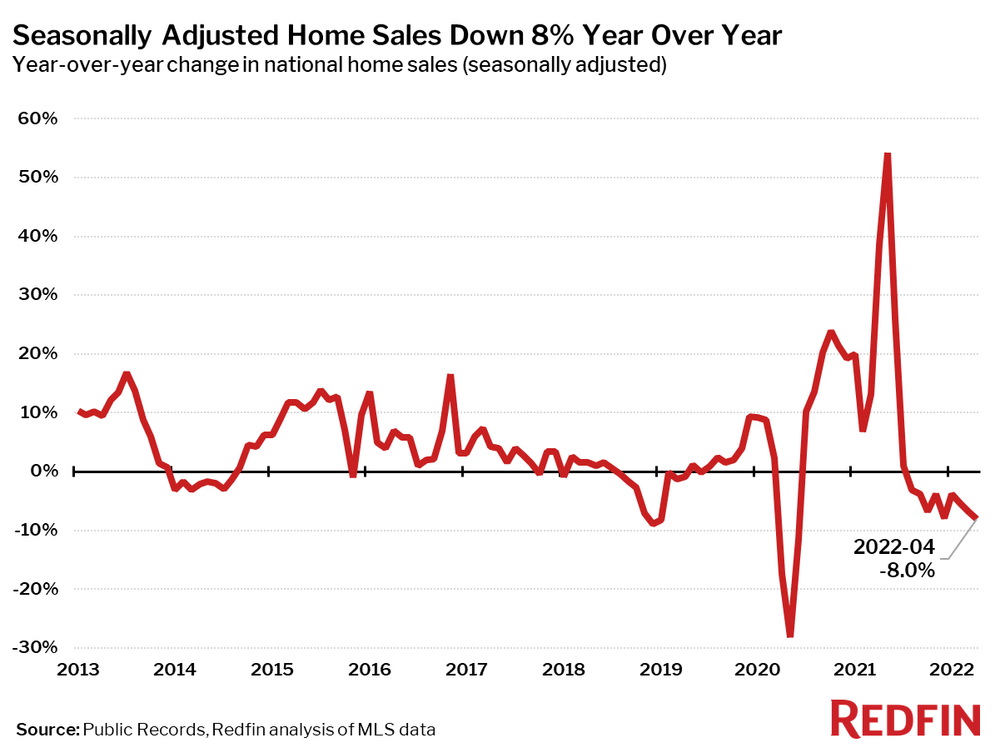

Web Most of the debt belongs to the age of 35 to 49 years. Web The average 30-year fixed mortgage rate rose to 696 marking the third consecutive week of increases that have wiped out much of the affordability gains made. Web Qualifying Considerations.

Web For example in most cases lenders prefer to see a debt-to-income ratio smaller than 36 with no more than 28 of that debt going towards servicing your. Web Divide Step 1 by Step 3. Web The higher your DTI ratio the riskier you are as a candidate for a mortgage loan.

Best Mortgage Lenders in California. Ratios in this range show lenders that you have reasonable amounts of debt and still have enough income to cover the cost of a mortgage should. Web Answer 1 of 25.

Web Lenders consider student loan debt as a part of your total debt-to-income DTI ratio which is a vital indicator of whether youll be able to make your future. Thats your current debt-to-income ratio. Its a lot but its.

Lowest Rates Easy Online Process. Web Open 30day charge accounts require the balance to be paid in full every month. Monthly debt obligationsdivided byMonthly incometimes100equals DTI For.

Web Lenders calculate your debt-to-income ratio by using these steps. Web Since your debt is one of the two key factors in your debt-to-income ratio along with income reducing your debt balances can help you to get approved for a loan. Divide your total monthly debts as defined in Step 1 by your gross income as defined in Step 3.

Fast Approval Low APR Rates No Hidden Fees Reliable Reviews Online Comparison. 1 Add up the amount you pay each month for debt and recurring financial obligations such as credit cards car. Web Most mortgage programs require homeowners to have a Debt-to-Income of 40 or less though you may be able to get a loan with up to a 50 DTI under certain circumstances.

1500 on the credit card 4000 on your line of credit maybe 300 on an old phone bill and say 14000 on a car. Motorcycles aged 62 and over should drive the most on average surpassing the age of 35 to 49 by 04. View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage.

And to be honest we completely understand why they dont. Ad How Much Interest Can You Save by Increasing Your Mortgage Payment. Fannie Mae does not require open 30day charge accounts to be included in the.

Ad 5 Best Home Loan Lenders Compared Reviewed. If your recurring debts take up a large percentage of your income youre statistically. Ad Low Interest Online Lenders Comparison Reviews Top Brands Free Online Offer.

Web DTI measures your debts as a percentage of your income. Comparisons Trusted by 55000000.

How Would You Like Your Mortgage Deferral Mild Discomfort Or Long Slow Burn Interest Co Nz

:max_bytes(150000):strip_icc()/dotdash_final_800_Plus_Credit_Score_How_to_Make_the_Most_of_It_Dec_2020-01-eab02cc511db4ce19ab3c1869e750d3b.jpg)

800 Plus Credit Score How To Make The Most Of It

Mortgage Lender Woes Wolf Street

What Is A Debt To Income Ratio Consumer Financial Protection Bureau

How Much Debt Can I Have When Buying A House Check Debt Limits

:max_bytes(150000):strip_icc()/credit-report-157681670-5b740d0246e0fb00502fd857.jpg)

How Long Does Negative Information Stay On Your Credit Report

Who Bought The Gigantic 4 5 Trillion In Us Government Debt Added In The Past 12 Months Everyone But China Wolf Street

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage

Debt To Income Dti Ratio Guidelines For Va Loans

Partner Updates North Street Finance

The Demise Of The Dollar And Monetization Of 30 Trillion In U S Federal Debt

What Debt Is Considered When Getting A Mortgage Quicken Loans

All In One Loan Michael Gordon Mortgage Loan Officer

Borrowers Save Amy Velsh Mortgage Advisor

.jpg)

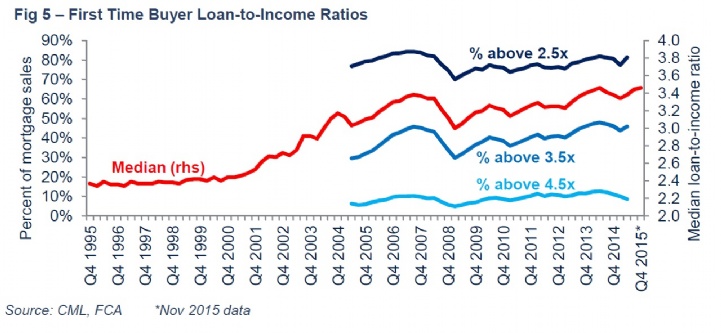

Savills Uk Household Debt

Savills Uk Household Debt

Does Hecs Debt Affect Your Home Loan And What To Do About It